By Gene Balas, CFA®

Investment Strategist

By now, most investors know the importance of diversification and prudent risk management. But exactly why does risk management make such a difference in long term returns (besides just smoothing out volatility)—even if you plan on simply buying and holding a portfolio for a long period of time? And what specifically constitutes a good risk management and/or diversification strategy? Let’s examine the former and then the latter.

A Mathematical Explanation of Risk

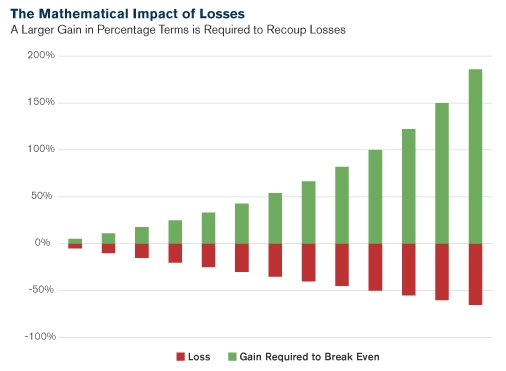

This part is pure math. If you start out with a $100 portfolio, and market conditions cause it to drop by 25%, the portfolio will be worth $75. To get back to $100, however, you’d need to generate a return of 33%. Similarly, if the portfolio lost half its value (to $50), you would need to earn a 100% return just to get back to where you started.

The basic lesson here is that not losing a dollar is far less arduous than having to regain that same dollar if it has already been lost. Unfortunately, while a more conservative portfolio can help reduce potential losses, it also reduces your potential for gains. There simply aren’t any realistic ways to avoid all losses and make only gains—at least absent very good (and persistent) luck.

With risk management tools in place, however, reducing the size of potential losses (even if the corresponding gains are also smaller) is often sufficient to still come out ahead. After all, consider the size of some of the large drawdowns in recent history, including the Tech Wreck bear market, the Great Financial Crisis, or even the more recent COVID bear market. While all of those losses were eventually regained, the associated ‘rides’ were highly unnerving for many investors—especially those who were on the cusp of retirement or needed access to their funds for other purposes.

The nature of market risk ultimately comes down to a fundamental tenet of investing: investors accept risk in order to earn a return on the funds they provide a business to fuel expansion, growth, and profit. Sometimes, unfortunately, those companies don’t succeed.

With that in mind, the market is continually repricing risk—based on every new economic, geopolitical, market and individual company data point. It’s this continuous repricing of risk which drives investments to fluctuate in value as investors assess the likelihood of each company being able to reward its investors with profits.

Tools to Manage Risk

So, what exactly can you do to effectively manage risk in your portfolio? How can you avoid the dilemma of needing larger gains to recoup smaller losses discussed above?

The simple answer (for many investors) is to diversify your stock portfolio with bonds. After all, it’s a strategy that’s always worked well in the past, right? Well, let’s look at the period from the early 1980s up until very recently.

During that time, bond prices surged as interest rates continuously fell from their double-digit peaks. History had been kind to a diversified stock-bond portfolio during that historical period. But during that time, the rate of inflation had also been falling—the Fed could therefore afford not to hike rates as far and as fast as it may now be forced to do (and instead often cut rates). Keep in mind that inflation is now at a 40-year high, and interest rates will likely go up (causing bond prices to decrease).

Moreover, in market environments like we’re currently experiencing, rising interest rates can trigger selloffs of both stocks and bonds at the same time. Diversifying your stock portfolio with bonds certainly won’t help much in that type of environment.

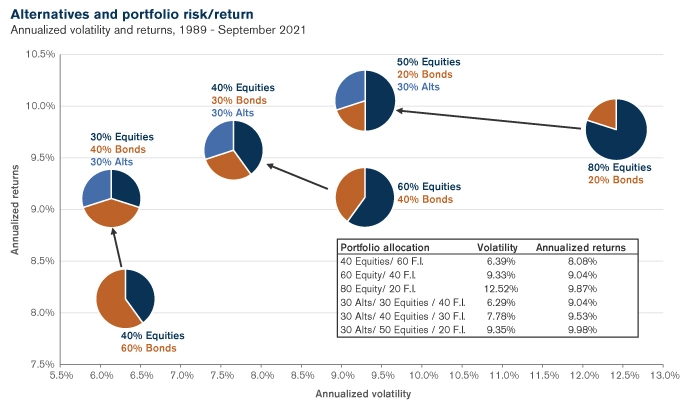

There are other strategies, however, which you may wish to consider. While these can’t entirely eliminate risk, of course, the idea is to focus more on diversifying to different risk factors than different asset classes. In other words, diversifying your portfolio among assets that have different sensitivities to things such as economic growth, inflation, commodity prices, real estate, credit risk, interest rates, geopolitical sensitivities, and so on.

Source: Bloomberg, Burgiss, HRFI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. JPMorgan Guide to Alternatives – U.S. Data is based on availability as of February 28, 2022.

Some strategies may use an active, tactical asset allocation approach to investing in traditional asset classes to spread out risk among different factor exposures. Other strategies may leverage alternative investments that invest in assets uncorrelated to major asset classes. Some may use complicated mechanisms for exploiting niche asset classes. And others may invest in real estate, commodities, private companies, or other areas that don’t fit neatly into the binary spectrum of ‘stocks and bonds.’

Conclusion

Based purely on mathematics (in terms of how much an investment will need to rebound in order to reverse previous losses), losing less money in the first place is far easier than trying to recoup lost funds. But since there’s no practical way to have no losses and all gains, it comes down to a question of risks—which ones to undertake (and at what projected level of profit) to justify an investment.

But there are ways to spread your risks around in more thoughtful ways than a basic stocks vs. bonds asset allocation decision. You may want to consider exploring various risk mitigation alternatives to determine the best way to manage your portfolio so you can feel confident that your risk/return tradeoffs suit your situation, goals, and personal preferences.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit signatureia.com/disclosures. Signature Investment Advisors, LLC (“SIA”) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SIA. SIA is a subsidiary of SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323, and its investment advisory services are offered independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.