By Gene Balas, CFA®

Investment Strategist

It’s an inescapable truth that although still the dominant player, the economic role of the U.S. on the global stage is gradually but steadily becoming smaller. According to the U.S. Census Bureau, the United States’ current population estimates of 333.1 million people represents just 4.2% of the world’s total population of 7.23 billion people.

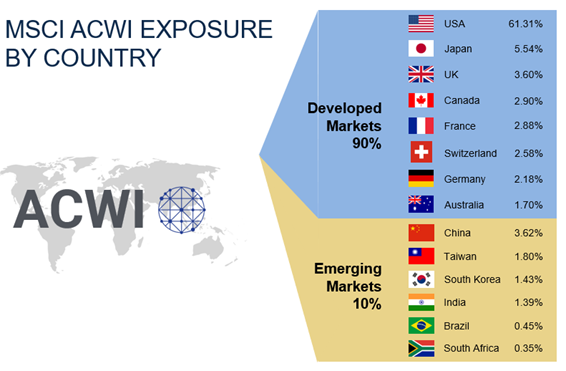

Even factoring in the stock market wealth in the U.S. vs. that of many countries globally, if you let “home bias” drive your portfolio decisions, you’ll be ignoring nearly 40% of the world’s market capitalization, as represented by the MSCI All Country World Index (or MSCI ACWI for short), and as seen in the nearby graphic. This index includes the U.S. as well as both developed and emerging markets. Without at least some international investment exposure in your portfolio, hundreds of other recognizable global leaders will be inaccessible.

And compounding this over-emphasis on the U.S. stock market (and economy), an over-concentration in U.S. stocks further limits your diversification—especially considering both your job and any real estate holdings are also probably tied to the U.S. economy. However, given extended recent periods of international stocks having generally underperformed their U.S. counterparts, can a strong case even be made for investing overseas? We would suggest that there are three fundamental reasons to adopt a global focus:

- Gaining exposure to world-class companies – wherever in the world they may be;

- Potentially enhancing diversification, including through currency exchange rates; and

- Harnessing the power of growing economies outside of the already-developed world.

Gaining exposure to a world of opportunity

Consider the things you own in your home or garage, the transportation infrastructure and communications services you rely on, the medications you take, or the everyday household products you use. Chances are, many of them were provided by companies domiciled outside of the U.S.

Production, consumption, and investment are all global in nature. What’s produced in one country may be consumed in another country and owned by a company in yet a third country. Arbitrarily limiting yourself to only stocks of U.S. companies eliminates the potential to invest in the many companies that make the everyday things we use. Foreign domiciled businesses not only sell a wide range of products we consume, they also employ countless American workers in factories across the country.

Achieving better portfolio diversification

Economies around the world each have distinct economic drivers. Thus, international markets may offer different investment return fundamentals. Some companies currently have (or are developing) large consumer-driven societies. Others are predominantly export-focused—producing industrial or consumer goods, or providing commodities used globally.

As a result of these differences, they do not always move in lockstep with each other; even though they may share common customers. And particularly relevant to the current climate, consider how the trend towards greater de-globalization is becoming a more pronounced theme—which may perhaps result in even less correlation between economies around the world.

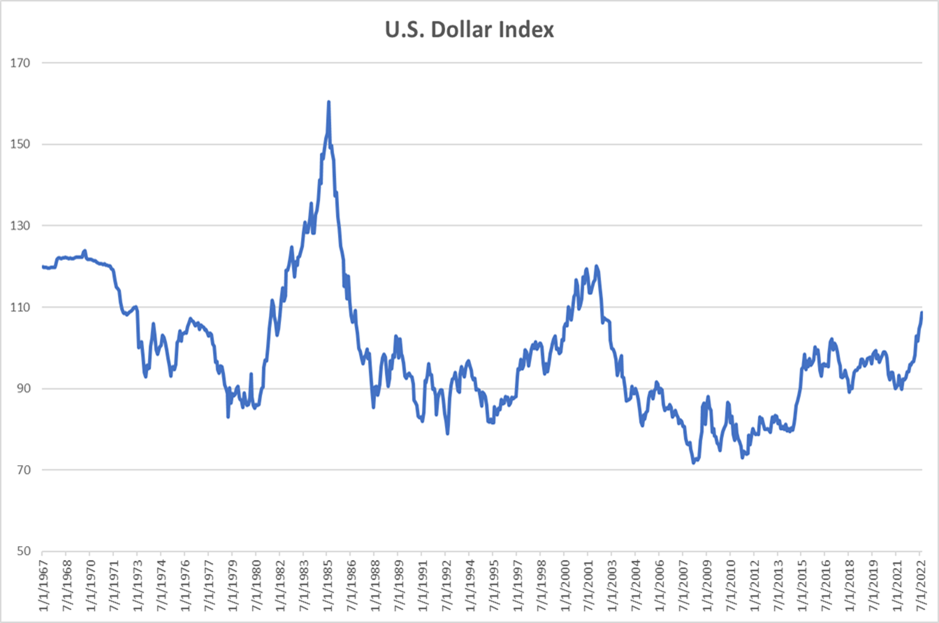

Diversifying internationally can also help your portfolio on the currency exchange front. Right now, the U.S. dollar’s strength relative to most of the world’s currencies is historically high. That means that one may effectively buy international stocks in the current environment at a lower price when the price of those stocks is translated into dollars.

And when it comes to investing, should the dollar weaken from its currently high levels, that would mean that those foreign currencies would be more expensive – and will then purchase more dollars, so owning shares of foreign companies can boost one’s portfolio value when the prices of those assets are translated back into U.S. dollars. And it’s no coincidence that a weaker dollar may sometimes coincide with periods when the U.S. economy – and investment opportunities stateside – arguably may not be as compelling as those potentially available elsewhere.

As to the aspect of currency translation, one reason why many international investments have lagged behind domestic stocks is due to the fact that the dollar has risen quite sharply. You will notice in this nearly 50-year chart, that currencies are not like corporate earnings. They don’t grow to the sky. They don’t compound over time. They mean revert. What goes up comes down, and vice versa. Given the role of the strengthening dollar in recent periods – which, as noted, will not continue into perpetuity – the underperformance of international stocks isn’t just a referendum on the fundamentals of those companies, it is also simply due to the fact that the dollar has strengthened in recent periods.

Source: Bloomberg

Economic growth prospects overseas

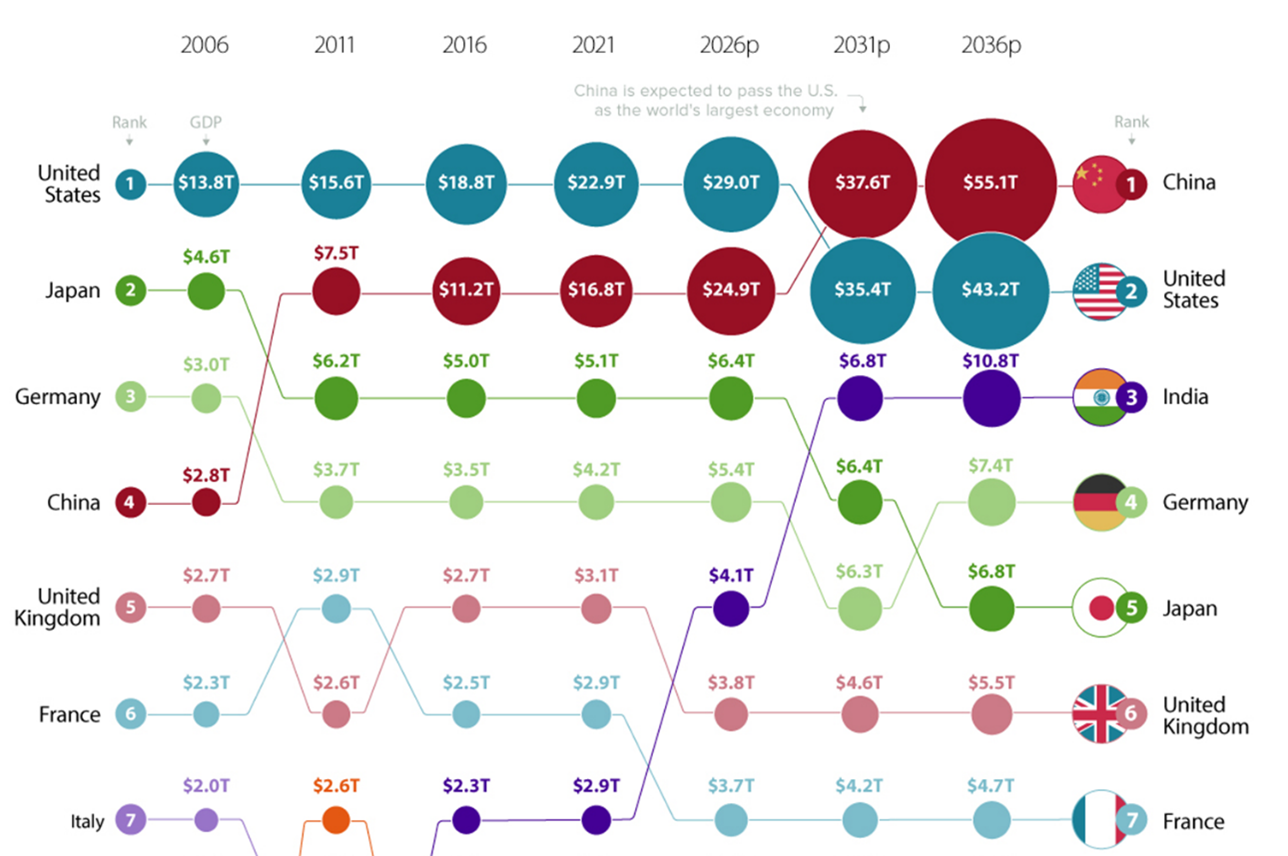

Perhaps most importantly, one may posit that other countries tend to have considerably more economic growth potential than the U.S., simply because our economy is already so developed. Meanwhile, those countries where middle class consumer societies are now beginning to grow larger may provide more attractive investment opportunities over the long term than countries with already mature economies. Consider the adjacent graphic showing the historical and projected size of certain global economies.

HISTORICAL/PROJECTED GDP

Sources: The Center for Economics and Business Research; The World Bank; Trading Economics

Due to the relative size of their populations, formerly smaller economies like China and India are expected to play a far greater economic role on the global stage than just a decade ago. But across the globe, a great many economies (both large and small) are becoming more prosperous—creating greater wealth that is also becoming more broadly dispersed across the population to build a new, larger class of consumers. In other words, a growing middle class in many countries around the world is accounting for a growing share of consumption, production, and investment in companies globally.

Some investment opportunities in these markets are to be found among companies located in close physical proximity to these new consumers. Yet many other global companies will certainly benefit from these trends considering how connected the world is. More and more we’re seeing opportunities driven by globalization (e.g., a European company with a profitable customer base in Asia; or a Latin America manufacturer whose commodities are distributed globally) as well as opportunities driven by demographics (e.g., an Asian retailer serving an exponentially growing number of customers in its home country).

Conclusion

Of course, the U.S. remains by far the largest component of the global stock market (refer to the nearby graphic) but by no means do we hold a monopoly on corporate wealth. Consider that about 40% of stock market wealth resides outside of the U.S., according to the aforementioned MSCI ACWI index. Many of those other countries are, of course, other developed markets. But a growing number of international economies may offer a potential for possibly greater investment opportunities than in many mature markets due to both economic and demographic tailwinds.

The nice thing is, adjusting your portfolio to be more globally oriented doesn’t necessarily require a drastic reallocation. Often, small strategic additions and substitutions can help you better capture the potential of international markets and harness them for your own financial benefit.

Definitions

The MSCI All Country World Index (MSCI ACWI) captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,898 constituents, the index covers approximately 85% of the global investable equity opportunity set. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit www.signatureia.com/disclosures. Signature Investment Advisors, LLC (SIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SIA. SIA is a subsidiary of SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323, and its investment advisory services are offered independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.